A Free Zone Company in Abu Dhabi is one of the most strategic decisions for entrepreneurs and investors aiming for fast growth and global market access. Abu Dhabi’s free zones provide a robust business environment, featuring 100% foreign ownership, tax exemptioEstablishing ns, and no restrictions on profit repatriation. These zones are tailored to accommodate various industries, backed by efficient infrastructure and government support.

The emirate is a top choice for Company Formation in Abu Dhabi Free Zone due to its simplified procedures, flexible licensing, and strong legal framework. Whether you’re launching a startup or expanding internationally, Establishing a Free Zone Company in Abu Dhabi sets you up for long-term success in a competitive market.

Why Choose ALPHA for Your Free Zone Company Setup?

For seamless and compliant Free Zone Company Setup, ALPHA offers expert guidance at every stage. With years of experience in Establishing a Free Zone Company in Abu Dhabi, ALPHA ensures a tailored and efficient launch process—no matter your sector or business size.

Step-by-Step: How to Set Up a Free Zone Company in Abu Dhabi

- Define Your Business Activity

Choose from categories like industrial, commercial, service-based, or tech-driven. Identifying your activity is the first step in Company Formation in Abu Dhabi Free Zone. - Select the Right Free Zone

- Abu Dhabi Global Market (ADGM) – Financial and legal firms

- Mussafah Free Zone – Manufacturing and industrial

- Khalifa Industrial Zone (KIZAD) – Large-scale industrial businesses

- Masdar City – Clean energy, sustainability, and R&D-focused businesses

- Choose the Legal Structure

Options include:- Limited Liability Company (LLC)

- Branch of a foreign company

- Sole Proprietorship

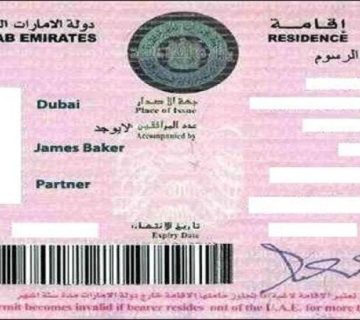

- Prepare Required Documents

- Passport copies

- Proof of residence

- Business plan

- Approvals (if applicable)

- Select Office Space or Facilities

Choose from smart offices, warehouses, or industrial units. - Register & Obtain Trade License

Submit documents to the free zone authority. Once approved, receive your business license—an essential part of Establishing a Free Zone Company in Abu Dhabi. - Open a Corporate Bank Account

Required for managing operations and transactions. - Hire Employees & Secure Work Permits

Visa and labor processes are streamlined in most Abu Dhabi free zones. - Stay Compliant

Ongoing compliance with free zone regulations ensures smooth operations.

What Is a Free Zone?

A free zone is a special economic area offering regulatory and tax benefits. These zones operate under independent commercial laws and are featured in the UAE free zone companies list. They’re perfect for investors seeking autonomy and global trade flexibility.

Types of Business Activities Allowed in Abu Dhabi Free Zones

- General Trading

- E-commerce and Digital Platforms

- Engineering & Manufacturing

- Consultancy (Legal, Marketing, IT, HR)

- Financial & Insurance Services

- Education & Training

- AI, Software Development & R&D

- Logistics and Shipping

Establishing a Free Zone Company in Abu Dhabi gives you the freedom to operate in any of these high-demand sectors.

Benefits of Establishing a Free Zone Company in Abu Dhabi

- Full Foreign Ownership

- Up to 50 Years Tax Exemption

- No Customs Duties on Imports/Exports

- Access to Global Markets

- Quick Licensing Procedures

- Innovative Office and Industrial Infrastructure

- Residency Visas for Investors and Employees

- Government Incentives and Support Programs

Whether you’re aiming for e-commerce, logistics, fintech, or sustainability sectors, Establishing a Free Zone Company in Abu Dhabi gives you the ideal launchpad.

Spotlight: Company Formation in Masdar City, Abu Dhabi

Company Formation in Masdar City, Abu Dhabi is ideal for clean tech, AI, and sustainable development companies. Masdar offers:

- Smart, energy-efficient infrastructure

- 100% foreign ownership

- R&D facilities and innovation hubs

- Proximity to Abu Dhabi International Airport

This makes it a top pick for Establishing a Free Zone Company in Abu Dhabi for green and future-focused businesses.

Understanding the Costs: Establishing a Free Zone Company in Abu Dhabi Cost Breakdown

Establishing a Free Zone Company in Abu Dhabi cost varies depending on:

- License type: Trading, manufacturing, or services

- Office type and location

- Visa and employee requirements

- Government fees and annual renewals

- Additional services like legal or consulting support

Typical expenses include:

- Commercial License and registration

- Office rental and facility usage

- Employee visas

- Legal and accounting services

To optimize your investment, consult ALPHA for cost-efficient Free Zone Company Setup packages.

Free Zone vs Mainland: Which Should You Choose?

| Feature | Free Zone | Mainland |

| Ownership | 100% foreign | Often requires local partner (except exempted) |

| Tax Benefits | Yes (up to 50 years) | No |

| Operating Territory | Inside free zone or international | Anywhere in the UAE |

| Setup Cost | Lower | Higher |

| Licensing | Streamlined | Broader but more complex |

If global scalability and low setup cost are your priorities, Establishing a Free Zone Company in Abu Dhabi is the ideal path.

Why Work with ALPHA?

From license issuance to bank account setup, ALPHA is your expert in Company Formation in Abu Dhabi Free Zone. We help you navigate legal frameworks, optimize costs, and fast-track approvals. Our goal is simple: make Establishing a Free Zone Company in Abu Dhabi as smooth, strategic, and profitable as possible.

Contact ALPHA

- Email: info@alphabudhabi.com

- Phone: +971561691648

- Location: Mussafah Industrial – M44 – Sheikh Sultan Bin Zayed Building, Abu Dhabi

Conclusion

Establishing a Free Zone Company in Abu Dhabi provides unmatched advantages—complete foreign ownership, zero tax, innovation-driven environments, and global reach. From Masdar to KIZAD, the opportunities are vast. With expert support from ALPHA, your Free Zone Company Setup becomes a hassle-free success.

Frequently Asked Questions

Can I open a business bank account in the UAE after setting up in a free zone?

Yes, once your license is issued, you can open a corporate bank account.

Are there annual renewal fees?

Yes, and they vary by free zone and business activity.

Can I shift from a free zone to the mainland?

Yes, but it requires re-registration and compliance with mainland regulations.

Where can I find a list of UAE free zones?

Refer to the UAE free zone companies list published by economic authorities or consult ALPHA for guidance.