Establishing an import company in Abu Dhabi is a strategic move for entrepreneurs aiming to leverage the UAE’s powerful trade infrastructure and international connectivity. With its prime geographic location, robust legal framework, and investor-friendly policies, Abu Dhabi is a key destination for import and export activities. Establishing an import company in Abu Dhabi offers investors access to state-of-the-art logistics, favorable tax regimes, and a business ecosystem designed to facilitate global trade.

Steps to Establish an Import Company in Abu Dhabi

The process of establishing an import company in Abu Dhabi requires following specific legal and regulatory steps to ensure compliance and operational efficiency.

Define Your Business Activity

- General goods import and distribution

- Electronics and tech devices

- Food and beverage items

- Heavy equipment and industrial raw materials

Choose a Legal Structure

When establishing an import company in Abu Dhabi, you can select from several legal formats:

- Sole Proprietorship

- Limited Liability Company (LLC) – typically requires a local sponsor for mainland operations

- Branch of a foreign entity

- Public or Private Joint Stock Company

Reserve a Trade Name

Ensure your trade name reflects your business and complies with Department of Economic Development (DED) standards. Unique and clear naming supports faster online company registration in UAE systems.

Obtain Initial Approval

Submit an application to the DED for pre-approval. This is one of the earliest steps to establish an import and export company in Abu Dhabi.

Secure a Business Location

Leasing an office or warehouse is essential. All lease contracts must be registered under Abu Dhabi’s TAMM system for legal validation.

Obtain a Commercial License

Key documents include:

- Commercial License application

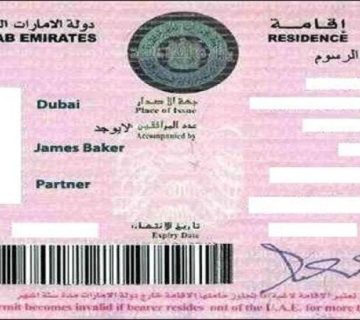

- Copies of all partner IDs and passports

- Notarized lease contract

- Memorandum of Association (if multiple partners)

Licensing is a core part of import company formation and is generally completed within a few days after document submission.

Register with Relevant Authorities

To legally begin operations:

- Register with Abu Dhabi Customs for an importer code

- Register with the Ministry of Economy for regulated goods

- Open a corporate bank account through a UAE bank

Open a Corporate Bank Account

A corporate account is mandatory to manage transactions and receive international payments for import and export company formation processes.

Begin Import Operations

Once licensed and registered, import operations can commence. This includes placing orders, ensuring compliance with UAE product regulations, and clearing goods via the customs portal.

Estimated Costs of Starting an Import Company

Understanding the costs involved in establishing an import company in Abu Dhabi is essential for planning:

- Government registration fees

- Office or warehouse rent

- Licensing and visa charges

- Customs clearance and shipping

- Marketing, legal, and accounting fees

Whether you’re targeting local trade or international commerce, clear cost planning helps secure long-term stability.

How to Obtain a Customs Code in Abu Dhabi

This code is crucial for all import and export companies in UAE.

Steps include:

- Register online via the Abu Dhabi Customs portal

- Upload business and identity documents

- Pay the required fee and receive your customs code within 48 hours

Important Notes:

- Customs codes must be renewed annually

- Accurate documentation prevents delays in import clearance

Tips for Successful Import and Export Company Formation

- Research market trends and product demand

- Ensure suppliers meet UAE quality standards

- Verify if special import permits are needed for food, medicine, electronics, etc.

- Draft legally binding contracts with suppliers

- Choose efficient logistics and insurance providers

- Use secure storage facilities and tracking systems

- Maintain compliance with VAT and customs duties

- Establish a professional digital presence for branding and credibility

ALPHA’s Role in Import Company Formation

When establishing an import company in Abu Dhabi, partnering with a setup expert like ALPHA simplifies the process. ALPHA offers:

- Expert support for online company registration in UAE

- End-to-end service from licensing to visa issuance

- Assistance with banking, HR, and insurance setup

- Reliable compliance, documentation, and renewal services

Contact ALPHA:

Email: info@alphabudhabi.com

Phone: +971561691648

Address: Abu Dhabi – Mussafah Industrial – M44 – Sheikh Sultan Bin Zayed Building

Conclusion

Establishing an import company in Abu Dhabi presents a powerful business opportunity. From legal structure to licensing and customs registration, every step plays a vital role in securing long-term success. With global trade routes, digital infrastructure, and supportive government services, import and export companies in UAE have the perfect foundation for growth. Whether you are new to the region or expanding an existing venture, establishing an import company in Abu Dhabi is your gateway to becoming a competitive player in the international trade market.

Frequently Asked Questions

Can foreign investors own 100% of an import business?

Yes. Depending on the business structure and location, foreign investors may fully own their import company, especially in designated zones and under updated UAE laws.

Are there specific permits required?

Yes, for certain goods like pharmaceuticals, electronics, and food items, additional approvals from relevant authorities are required.

What is the timeline for setting up?

Establishing an import company in Abu Dhabi typically takes 7–14 working days depending on document readiness and approvals.

لا يوجد تعليق